We are in business to help you thrive

At Q-Card, we aim to offer our partners top-tier professional services and products. Q-Card is designed to provide more value than all existing expense management software/platforms which are generally used to reimburse employees or simply reduce some manual expense handling. We offer you an all-in-one purchasing tool created for the complexities large businesses face and beyond, ultimately helping them to get their tail spend back under management.

4 reasons why we are a good fit

Simplicity

Finance is complex, but managing it shouldn't be. We ensure your processes run smoothly and stress-free.

Field Experts

To achieve our goals, we collaborate with the leading financial technology provider in the industry: Adyen.

Customer Centric

At Q-Card, we view our customers as partners. As Volkswagen once said, "Small enough to listen, big enough to perform."

Integration experts

Our mission

Our mission is to empower employees and unlock business potential by revolutionizing how companies manage their long-tail spend. We believe trust, autonomy, and simplicity are the keys to unlocking a more efficient and effective working method. By putting payment means directly in the hands of those who make it happen: our end-users, we give them the freedom to make smart purchasing decisions while saving time and resources for the entire organization. Through our innovative solutions, we aim to create a workplace where employees feel valued, recognized, and empowered to drive business forward. Together, we are shaping the future of tail spend management with Q-Card's virtual payment cards.

Vision

We envision a future where seamless, efficient, and compliant financial transactions empower businesses to focus on innovation and growth. By revolutionizing tail spend management through our cutting-edge automation solutions, we aspire to simplify the complexities of corporate spending, enabling every employee to unlock their potential with the freedom and security of virtual payments. Together, we will transform how organizations manage their corporate tail spend, fostering a culture of transparency, agility, and collaboration in every corner of the globe.

Simplicity

Collaboration

Autonomy

Excellence

Trust

Result-oriented

A journey beyond virtual cards

Reflecting on Q-Card's journey, one constant has been our commitment to foster 'collaboration'. This principle underpins our approach today, where our customers engage in more than just expensing, reimbursing, reporting, submitting, or closing their financial records. We believe that company spending should be entrusted to all employees and teams, streamlined through automation, and foster a culture of responsible financial management. It is essential for finance teams to collaborate closely with marketing, sales, IT, and all other departments, rather than operating in isolation.

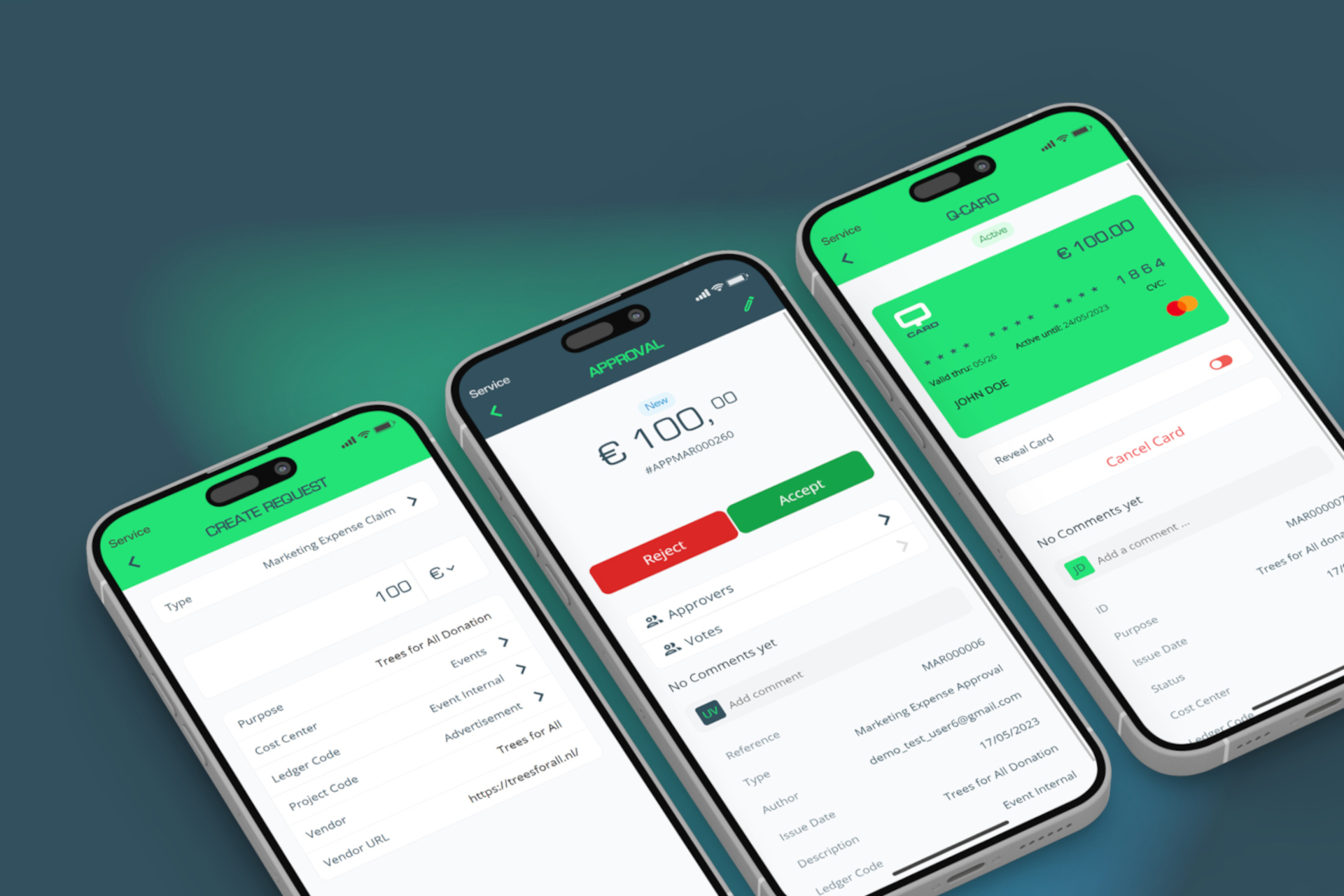

Curious how it works

Q-Card Virtual Cards offer a smarter way to manage your company's long-tail spend. Give your employees the power to explore the world of corporate virtual payment cards.

Our intelligent solution suites

Procurement

Enable your procurement team to focus on managing key suppliers and tasks that add value. Improve spend analytics, while bringing overall tailspend under management.

Finance

Gain more control over corporate spending and enhance visibility through real-time financial spend tracking, furthering the capabilities of tail spend analytics for finance departments.

HR

Eliminate personal funding or private cards for corporate expenses today! Q-Card is an expense management solution for everyone with an easy and intuitive consumer-like buying experience.

IT

Adopt a secure and standardized solution that works for international multi-entity organizations and can integrate simultaneously with multiple ERP, Accounting and Financial systems.

FAQ

Q-Card is designed to function as more than just a platform where you can efficiently manage all your spending with cost-saving functionalities. It is also more for your employees than just a tool for reimbursing their corporate expenses.

Instead, it is all of the above and more, as employee purchases with personal funds and reimbursements are no longer necessary.

A Q-Card request can be seen as equivalent to a traditional purchase request. An approved Q-Card serves as a purchase order through a standard approval model but is integrated with a payment method that the requester uses directly. This is how Q-Card differentiates itself from other spend management providers.

Yes, the Q-Card is designed to cater to the needs of corporations that often have multiple business units.

Our dashboards can provide visibility for either your entire group's spending, or you can choose to give each business unit its account/dashboard.

Furthermore, the Q-Card helps control cash flow and currencies, streamline the accounts payable process, and simplify approval workflows across multiple business units.

Reach out to us to discover additional ways we can support your group's entities.

Q-Card provides top-notch payment security for businesses.

The virtual Q-Card supports the 3D Secure authentication protocol to verify card-not-present (CNP) transactions.

Our app safely manages personal information, including name, email, and mobile number, which are associated with users to facilitate requests and enable the use of 3D secure authentication and single sign-on.

Traditional "after the fact" processing limits procurement and budget holders from proactively referring to preferred suppliers.

The limited influence and control over expenditures that most organizations face result in employees not always making the right purchasing decisions, which is understandable.

Therefore, it is possible to set up an approval process with Q-Card, so that the right stakeholders always first have insight into upcoming expenses and can approve them before using the virtual card. Post-approvals are, of course, also possible; we will work with you to determine how the approval structure should be implemented.

Thanks to our strategic partnership with Adyen, Q-Card can create virtual cards from Mastercard and Visa.

CPO Strategy - Issue 41

Heijmans & Q-Card: Constructing Procurement

Heijmans developed an influential relationship with the Q-Card App at the beginning of 2023. The firm opted for Q-Card's virtual cards to bring their spend under management. By adding Q-Card to its 2023 digital agenda, Heijmans is extending its P2P process, improving upfront visibility and cost control for a wide range of indirect spend categories throughout multiple departments.

Keep exploring

ROI Calculator

Download our comprehensive practical guide and empower your team with proven methods to secure stakeholder buy-in, accelerate decision-making, and lay the groundwork for successful transformation in tail spend management.

Heijmans opts for innovation

Construction company, Heijmans, has opted for Q-Card’s virtual cards to bring their spend under management. By adding Q-Card to their 2023 digital agenda, Heijmans is...

Q-Card launches innovative app

The new Dutch fintech label, headquartered in Rotterdam, Q-Card allows companies to provide their employees with virtual payment cards through a uniform tail spend management solution.

Ready to get started?

Get more insights today

Our scans help corporations identify the right improvement potential with Q-Card. They provide an objective assessment of current performance and insights into financial benefits that can be monetised by managing tail spending.