Q-Card for Finance Professionals

Simplify, control, and optimize company spending in real-time. Q-Card allows you to execute supplier payments with all related contexts and work more efficiently with filtered views for payment runs. It eliminates the risk of duplicates, overdue invoices and unauthorized spending.

Track long-tail spend in real-time on one platform

And not after it happens. Q-Card provides a dashboard for easy monitoring of transactions, allowing your finance team to make quick decisions based on real time financial insights.

Automated reconciliation & reporting

No more manual work. We ensure your reconciliation process is automated. All transactional data and captured documents are sent directly to the underlying ERP or multiple ERP systems.

Pre-approval workflows and spend limits

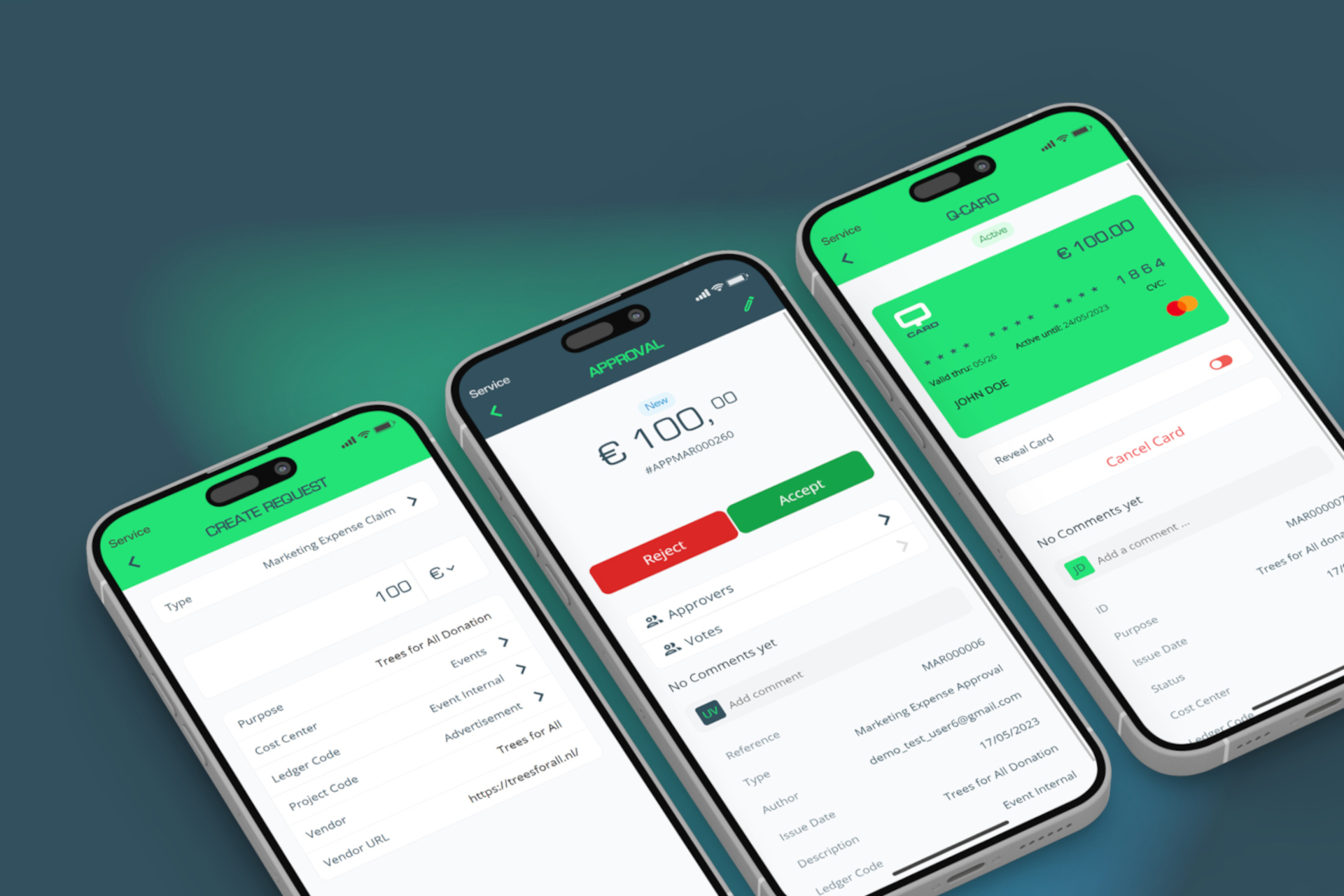

Enable teams to make purchases within minutes while maintaining control over costs. Q-Card allows you to set spending limits and approval workflows for each card, ensuring compliance.

Why finance professionals choose Q-Card

Working in the finance department often means correcting the mistakes of others. Unstructured processes and a limited overview of purchases, approvals, and missing details like receipts can cost time and money that could be better utilized. With Q-Card, we tackle the problem at its source and aim to modernize and simplify the online and offline purchasing process and expense management.

No more physical credit cards being constantly passed around, which poses a potential security risk, or paying with personal credit cards and waiting a long time for reimbursements. Equip your team with high-quality virtual Q-Card payment cards, powered by Adyen, Europe's largest payment service provider, allowing you to pay for and process all small and large purchases that you and your department need.

With the implementation of Q-Card, we provide customers with upfront insight and control over all indirect expenses with real-time dashboards and insights for budget managers and the corporate finance department.

Stop wasting time with internal communications

Does your Finance team receive invoices without knowing their purpose or who made the purchase? Are you also spending too much time tracking receipts and correcting details like cost center, cost type, general ledger code, project code, or VAT percentages?

Streamline and automate your workflow with Q-Card, minimize these time-consuming and non-value-adding tasks, and close the month faster!

Virtual cards for one-time or recurring use

Approve and pay anywhere at

any time

One of the main advantages of virtual cards, especially for large organizations operating worldwide, is the ability to quickly approve and issue virtual cards with the required budget for employees in seconds. There is no longer a need to wait for physical cards to be created or physically handed over by a colleague before your team can make a purchase. With Q-Card, you can submit the purchase request, receive approval while on your way to the store, and immediately purchase what is needed for your colleague to finish the job.

Stop chasing receipts

Once an employee makes a purchase with a Q-Card virtual card, they can instantly upload their receipt and any other required documents. If they happen to forget, Q-Card steps in by sending regular, friendly reminders. Thanks to this proactive approach, we consistently achieve a high success rate of over 90%, ensuring efficient expense management.

Close the month faster

Classic credit card processes and expense management platforms are time-consuming, causing delays in month-end reconciliation. Additionally, many of these platforms fail to meet organizational need as they cannot deactivate credit cards or implement a streamlined expense policy that enables accountability within the team.

Run a Quick Scan

Curious about how to quantify the financial impact of adopting the Q-Card for your organization? Contact us to discuss the various possibilities and how we can assist you in making the analysis and setting up the business case.

What's in it for finance?

Why Q-Card makes the lives of finance professionals easier

Finance professionals juggle a variety of responsibilities, including budget oversight, compliance management, ensuring the accuracy of financial reports, and forecasting.

With so many responsibilities to manage, they can benefit from a helping hand. That’s where Q-Card comes in, enabling finance teams to focus on the strategic decisions that drive business success.

FAQ

All expenses processed via the Q-Card app and all declined expenses or virtual card requests are included. The Q-Card app is typically used for a wide range of business expenses, which are tracked. These include travel and entertainment costs, office supplies, one-time vendor purchases, and other indirect expenses. It can also be used for expenses at vendors with, for example, only 10 purchases a year. The availability of a Q-Card for your employees depends on your organizational policy. It is designed to provide visibility into long-tail spending, which is often difficult to manage.

Yes, all transactional data can be automated by integrating with your back-end financial or ERP system, including general ledger codes, cost centers, project codes, documents, etc. We are also familiar with integrating multiple back-end systems simultaneously, in case your organization has different entities and therefore systems. We always aim for smooth data transfer, accurate expense reporting, and simplified reconciliation within your existing financial setup.

Q-Card offers customizable policy controls, including multi-approval workflows, spending limits, and more, which enable you to enforce specific compliance rules. These features ensure that all purchases are subject to company guidelines, minimizing the risk of unauthorized spending. Contact our sales team if our options align with your company policy.

Q-Card offers competitive pricing, and we are always available to develop a positive business case for both parties involved. Check out our Quick Scan and Full Scan page for our options. Specific costs depend on your organization’s requirements and volume, so please contact us for a tailored estimate based on your needs.

The user can already provide the available tax rate(s) after the receipt or invoice is uploaded. We ensure they are reminded if they forget. Q-Card assists with VAT recovery by automatically sending the aforementioned coding and documents you need and reconciling those with your ERP or accounting system.

CPO Strategy - Issue 41

Heijmans & Q-Card: Constructing Procurement

Heijmans developed an influential relationship with the Q-Card App at the beginning of 2023. The firm opted for Q-Card's virtual cards to bring their spend under management. By adding Q-Card to its 2023 digital agenda, Heijmans is extending its P2P process, improving upfront visibility and cost control for a wide range of indirect spend categories throughout multiple departments.

Keep exploring

A dive into the cold and dark waters

This is an image of my Ironman start in Switzerland. Imagine 1,500 people immersing themselves in a big lake and trying to navigate their way through as quickly as possible.

Heijmans opts for innovation

Construction company, Heijmans, has opted for Q-Card’s virtual cards to bring their spend under management. By adding Q-Card to their 2023 digital agenda, Heijmans is...

Q-Card launches innovative app

The new Dutch fintech label, headquartered in Rotterdam, Q-Card allows companies to provide their employees with virtual payment cards through a uniform tail spend management solution.

Optimize your tail-spend

Get started with Q-Card today!

If you are interested in learning more about quantifying the financial impact of adopting Q-Card for your organization, contact us to discuss the various possibilities and how we can assist you in making the analysis and setting up the business case.