Payment Options

Virtual Credit Card Secure Payment Options

Use secure online payments for online purchases, in-person POS payments by using the digital wallet, recurring payments for subscription services or pay the invoice of one of your long-tail spend suppliers. All in one tool!

Secure online purchases

Pay instantly online with the credit card information that is only available to you as the cardholder! Add your Q-Card number, expiration date, and CVC code, and the invoice is immediately paid. No personal up-front payments are required.

In-person POS transactions

Add your Q-Card to your Apple or Google wallet on your phone and simply pay using tap-pay. Unlock the credit card with your Face ID or PIN Code and you use it anywhere you go! Directly upload your receipt so that all your to-do's are complete.

Recurring subscriptions

Link the Q-Card virtual payment card to your recurring subscription fees, so you do not have to worry about those payments anymore. Simply enable the auto-pay functionality, link the payment receipts for the transactions and all is done.

Are you still struggling with manual expense reports?

Experience a more efficient solution with Q-Card Virtual Cards. Gain control over your long-tail expenditures and enable your employees to navigate the realm of corporate virtual payment cards.

Pay your longtail suppliers via Q-Cards bank transfers

Require physical credit cards? No problem, we got your back!

Whether you want to work in the digital, more sustainable way or whether you prefer the traditional physical credit card option, we can support you with either!

We encourage you to use virtual credit cards as those have improved fraud protections as well as higher security layers, next to being easier to hand out to employees and being more sustainable. However, we do support physical credit cards on request per user. Those will ensure that the Q-Card holder is backed in any case needed.

Fast and easy user onboarding

Add your users in the platform User Interface or via an integrated API connection to your ERP. With the help of Single Sign-Ons, your users will have no problems to be connected to our apps! Come and join the new way of user credit card onboarding!

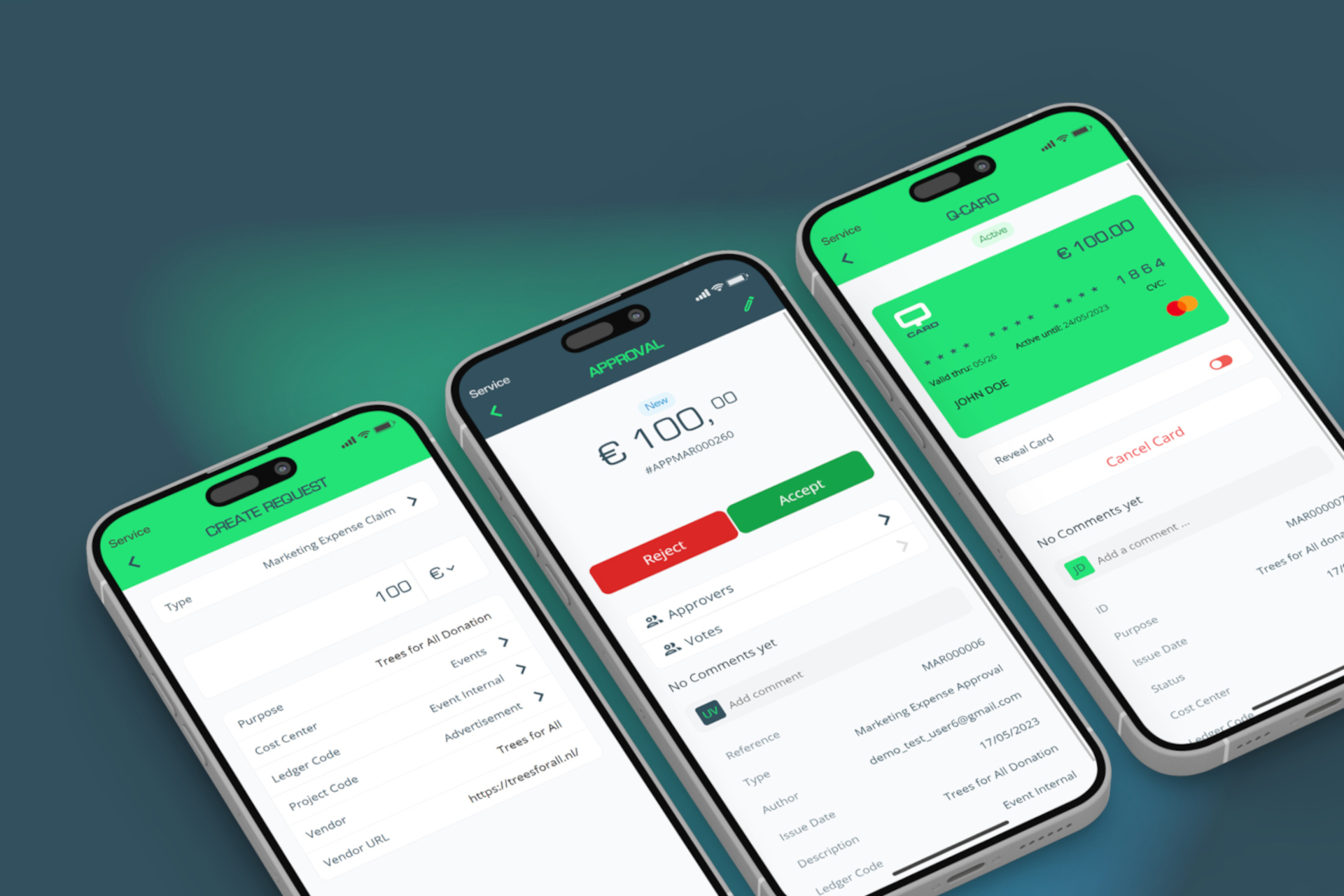

One app to track all payments

Embedded fraud protection

User-friendly interfaces

Use the Q-Card while you are at work on your laptop and paying suppliers' invoices or use your mobile app to pay the gas station or restaurant fee for your customers' dinner - all channels offer a convenient way for the end user to access the tool and the Q-Cards when and wherever needed. The card is only one click away!

FAQ

Each Q-Card can be connected to your digital phone wallet. When being asked to pay, open the Q-Card in your phone wallet (Apple or Google wallet) and hold or tap the card on a contactless-enabled card reader. The cardholder's payment information is securely stored in the NFC chip and transmitted to the merchant's terminal for authorization. That way, no physical card is required anymore.

Instead of using a credit card, the Q-Card application can also initiate a bank transfer. To do so, the requester must initiate the transfer and include an attached invoice document, as well as the beneficiary details, payment date, invoice reference, and a valid IBAN. This request follows the same approval process as a standard expense request and must be approved by the relevant management team. Once approved, the invoice is exported to the ERP which in return will mark the invoice as paid by updating the payment date and attaching VAT and payment confirmation documents.

A small processing fee will be charged for each invoice paid by Q-Card and processed through our app. The rates for this and other services we offer are always customized and are transparently presented by our team at the time of making a proposal.

The payment receipts can be added to the application itself. The easiest way is to open the Q-Card app on the mobile device and navigate to the third tab which holds the individual transactions. In there, a picture can be uploaded or taken. Payment receipts can however also easily be uploaded via the laptop by clicking on the paper clip symbol.

As a member of the System Administration team, the user can add and manage users and teams for the linked branch account. Within the "Users App", new users can be added by entering their email address, first and last name, and role. The next step is to assign the newly added user to a team. In the "Teams" tab, the system admin can either create a new team or assign users to existing teams. These tasks can also be performed via API, allowing new users to be automatically integrated when added to the internal ERP system.

Q-Card App Insights

Get your free download

Don't miss out — download the Q-Card factsheet now and equip yourself with the facts that matter!

Keep exploring

ROI Calculator

Download our comprehensive practical guide and empower your team with proven methods to secure stakeholder buy-in, accelerate decision-making, and lay the groundwork for successful transformation in tail spend management.

Heijmans opts for innovation

Construction company, Heijmans, has opted for Q-Card’s virtual cards to bring their spend under management. By adding Q-Card to their 2023 digital agenda, Heijmans is...

Q-Card launches innovative app

The new Dutch fintech label, headquartered in Rotterdam, Q-Card allows companies to provide their employees with virtual payment cards through a uniform tail spend management solution.

Get started with Q-Card

All your business spend in one place?

Schedule one of our assessments below to identify the highest priority for managing your long-tail spend. This evaluation provides concrete insights into the cost-benefit achieved through our Tail Spend Analyzer tool.