Q-Card Features

Virtual Cards for Secure and Flexible B2B Spending

Empowering expense management with customizable authorization and reconciliation processes, offering virtual card options tailored to meet diverse business needs, such as single-use, multi-use, or country-specific restrictions.

Flexible Approval Phases

Supporting various approval lifecycle options, depending on the expense type and expense amount, managerial approval could be required. However, auto-approval limits can allow a user to use the Q-Card immediately and managers can review purchases and purchase receipts once transactions are finalized.

Secure Virtual Credit Cards

Q-Card Virtual Cards function like a traditional Mastercard with 3D Secure verification and transaction tracking. They can be configured for single use or multiple uses with many individual transaction rules for improved corporate spending with the ease of automatic closure upon reaching a predefined threshold.

Accounting and Compliance

Q-Card transactions are automatically captured and categorized within the expense management application. Accounting teams can review and validate all corporate expenses, VAT data, and receipts. Transactions can be exported to any ERP or Financial system via API or EDI for seamless integration with your accounting workflows.

Recurring Expense Management Software with Bank Transfer Options

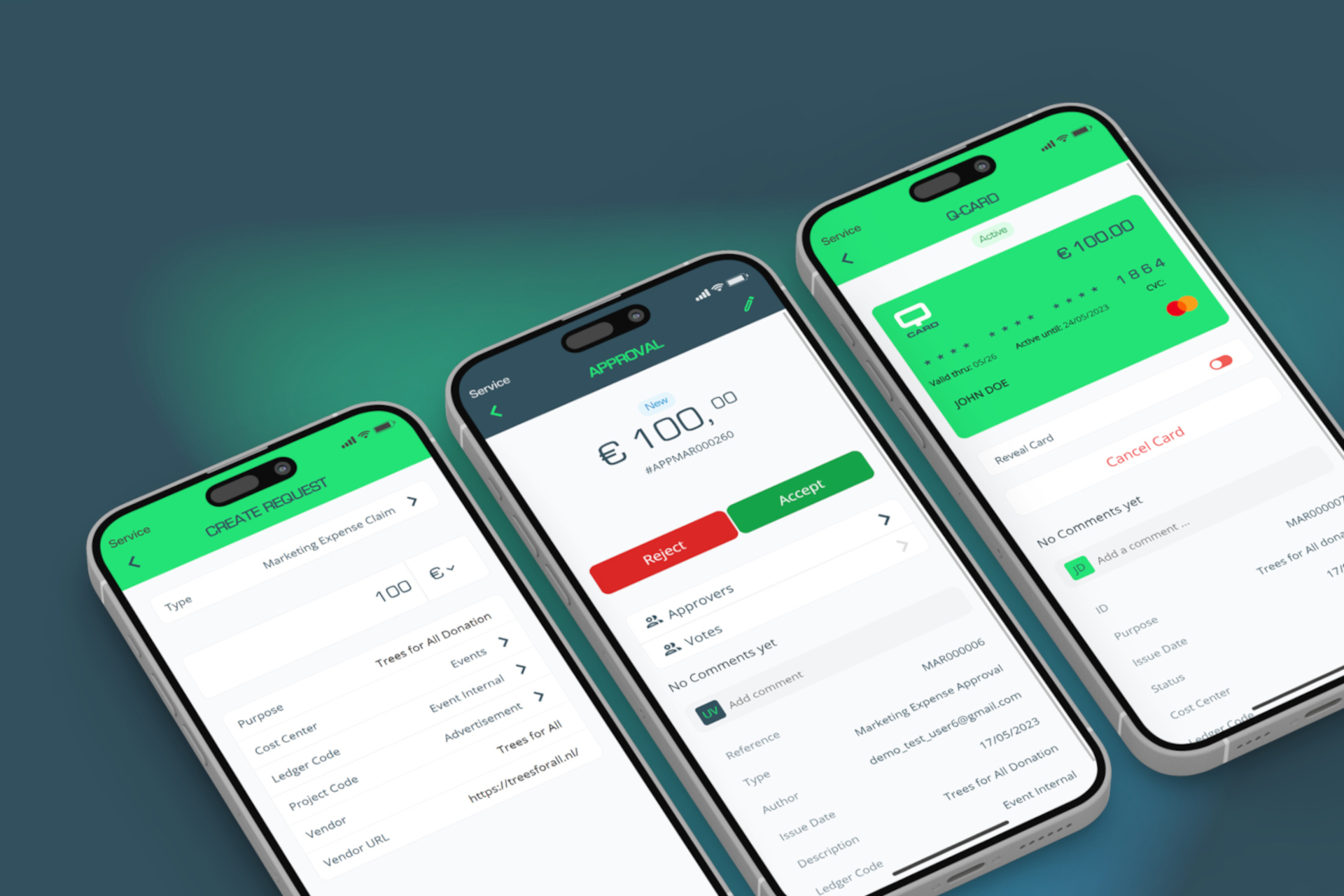

Mobile-Ready real-time spend tracking App

With Q-Card, you can allow your workforce to pay and track expenses with their phones in a secure online way. Users can create expense requests, review existing Q-Cards, and pay with a virtual credit card while using the digital wallets of their phones. After paying with the digital wallet, they can immediately upload their payment receipt using the phone camera. This is secured by using enhanced state-of-the-art fraud prevention tools in the background. Simultaneously, approvers can review, approve or decline purchase requests, or comment on open expense requests. All in one open app!

Virtual Card for Secure Business Spending

With the help of security protocols, such as 3D Secure authentication, we ensure the validity of the virtual card transactions and verify the cardholder's identity. Whilst using this technology, the credit card issuer, the merchant's bank, and the payment platform are verified during each transaction to ensure a secure online purchase.

Mobile receipt capture for expenses and add VAT data

Q-Card App for Accounting Teams

Transaction Tracking and ERP Integration

Based on company settings, we can export the final invoice lines to the ERP system. This can be done via API or EDI integration, all in real-time or in batches. Additionally, analytic tools are available to track the spend KPI to gain more visibility and control.

Still wrestling with manual expense reports?

Discover a smarter way with Q-Card Virtual Cards. Take control of your long-tail spend and empower your employees to explore the world of corporate virtual payment cards.

This is what industry peers have to say

“By adding Q-Card to our digital agenda, Heijmans is extending its P2P processes, improving upfront visibility and control for a wide range of indirect spend categories throughout multiple departments. Another key goal is to leverage efficiency gains by reducing the current ERP vendor base consisting of a large variety of C-suppliers for small or infrequent purchases."

Job Verkerke

Chief Procurement Officer

FAQ

The Q-Card App supports users to make requests for all B2B online purchases and allows to pay for them with one-time released virtual credit card after the approval limits you have set in advance.

Q-Card supports card issuing for virtual VISA cards and Mastercards that are accepted worldwide by all major online payment systems. With Q-Card's extensive worldwide coverage, you can also pay in various currencies.

Yes, Q-Card uses EDI or API integration to easily connect with accounting and ERP systems. Accurate, effective, and real-time cross-platform financial management is made possible by this integration, which facilitates seamless data synchronization and automatic payment reconciliation.

Q-Card provides several advantages for controlling travel expenses, such as:

- Cards that are pre-funded with specific travel expenses

- Increased security in contrary to actual cards

- Monitoring and reporting expenses in real time

- Increased awareness and control over travel expenditures

Yes, you can use the Q-Card in different currencies as well. Different funding accounts per currency can be setup in order to issue cards in multiple currencies.

Q-Card App Insights

Get your free download

Don't miss out — download the Q-Card factsheet now and equip yourself with the facts that matter!

Keep exploring

A dive into the cold and dark waters

This is an image of my Ironman start in Switzerland. Imagine 1,500 people immersing themselves in a big lake and trying to navigate their way through as quickly as possible.

Heijmans opts for innovation

Construction company, Heijmans, has opted for Q-Card’s virtual cards to bring their spend under management. By adding Q-Card to their 2023 digital agenda, Heijmans is...

Q-Card launches innovative app

The new Dutch fintech label, headquartered in Rotterdam, Q-Card allows companies to provide their employees with virtual payment cards through a uniform tail spend management solution.

All in one centralized system

Control long-tail spend with ease

Book one of our scans below to determine the top priority to bring your tail-spend under management. With this evaluation, we offer tangible information on the cost-benefit gained through our Tail Spend Analyzer tool.